Tax by Instalments

| Important: To help Canadians affected by COVID-19, the Canada Revenue Agency (CRA) and Revenu Québec have extended the deadline to file your 2019 tax returns to June 1, 2020. Deadlines to pay taxes and tax instalments for individuals and self-employed taxpayers have also changed. Refer to our help article Tax updates due to COVID-19 for more information. |

Paying taxes by instalments means that instead of paying the tax you owe all at once on or before April 30th, you pay the tax owed in smaller, lump sum amounts, over the entire year.

You might have to pay taxes in instalments on the following income if taxes weren’t withheld (or the required tax amount wasn’t withheld):

- Self-employment income (including fishing or farming)

- Rental property income

- Certain pension payments

- Investment income or

- Income from more than one job

Your province or territory of residence and the net taxes that you owe on December 31, determine if you have to pay tax instalments.

You have to pay your taxes by instalments for 2020 if both of the following conditions are met:

- your net tax owing for 2020 will be above the threshold for your province or territory ($1,800 or $3,000)

- your net tax owing in either 2019 or 2018 was above the threshold for your province or territory

If you were a resident of Québec on December 31, use the threshold of $1,800 for your net taxes owing. For any other province or territory, use the threshold of $3,000.

You can find more information on paying taxes by instalments on the Canada Revenue Agency (CRA) website.

Tax instalment payments are made on a regular basis, directly to the CRA or Revenu Québec and are due on:

- March 15

- June 15

- September 15

- December 15

Remember, if you don’t make the required payments on time, the CRA and/or Revenu Québec can charge you interest and penalty on the amounts that you owe.

You can see your instalment payment information by accessing the My Account service on the CRA website or the Revenu Québec website.

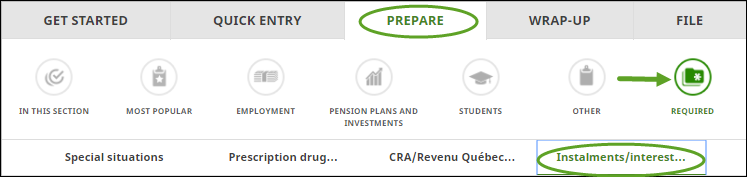

Follow these steps in H&R Block's 2019 tax software:

- Under the PREPARE tab, click the REQUIRED icon.

- On the Instalments/interest ... page, answer Yes to the question about making recurring tax payments in 2019.

- Enter the total amount of tax paid in instalments to the CRA (and/or to Revenu Québec if you're a resident of Québec) in the designated field.

- Scroll to the bottom of the page and click Continue.

- I received interest payments from the CRA or Revenu Québec (H&R Block Online Help Centre article)

- Instalment payments of income tax (Revenu Québec website)

- What is my account? (Revenu Québec website)

- Paying your income tax by instalments (CRA website)