Northern Residents Deductions (T2222 and TP-350.1-V)

If you lived in the northern regions of Canada for at least 6 consecutive months, you might be able to claim a residency deduction and/or the deduction for travel benefits on your tax return using form T2222: Northern residents deduction.

Note: If you're a Québec resident, you can also claim the related provincial deductions on your Québec tax return, by completing form TP-350.1-V. Fortunately, the T2222 and the TP-350.1-V forms are combined in H&R Block’s tax software.

Where you live will determine the deduction amounts you’re entitled to. For example, you can claim the deduction amounts in full if you live in a prescribed northern zone (Zone A). If you live in a prescribed intermediate zone (Zone B), you’re only eligible for half of the deduction amounts. To find out if you live in one of those zones, click the following links:

- Northern zone (Zone A)

- Intermediate zone (Zone B)

- Northern zone (Zone A) – Québec only

- Intermediate zone (Zone B) - Québec only

If you lived in a prescribed zone for work for at least 6 consecutive months, but your permanent home is elsewhere, you still might qualify for a deduction. Visit the CRA website for more information on temporarily living at special work sites.

The residency deduction is for northern residents who live in a prescribed zone on a permanent basis in a house, apartment, mobile home, etc. If you lived at a camp, bunkhouse, hotel room, dormitory, or boarding house, you won’t be able to claim this deduction.

The residency deduction has two parts:

- a basic residency amount and

- an additional residency amount

The basic residency amount is based on the number of days you lived in a prescribed zone in 2019. Generally speaking, absences won’t affect your period of residency (for example, if you go on vacation) but it depends on your reason for leaving and how long you were gone.

The additional residency amount is based on the number of days you used to calculate the basic amount if:

- You lived in and maintained a home located in a prescribed zone

- You’re the only person in the household claiming the basic residency amount

You can claim the following deduction amounts:

- If you lived in a prescribed northern zone (Zone A):

- a basic residency amount of $11.00 for each day that you lived in this zone plus

- an additional residency amount of $11.00 for each day you lived in this zone if you maintained a residence and you are the only person claiming the basic residency amount

- If you lived in a prescribed intermediate zone (Zone B):

- a basic residency amount of $5.50 for each day that you lived in this zone plus

- an additional residency amount of $5.50 for each day you lived in this zone if you maintained a residence and you are the only person claiming the basic residency amount

Important: Everyone in your household can claim the basic residency amount if they qualify for it. However, if more than one person in your household is claiming the basic amount for the same period, no one can claim the additional amount. Therefore, it might be beneficial for you to decide if one of you should claim the basic and additional residency amount or whether all members of the household should just claim the basic residency amount.

For more information on the residency deduction, visit the CRA website.

If you didn’t live in a prescribed zone on a permanent basis, you might still qualify for the basic residency amount if you lived at a special work site that’s located in a prescribed zone (within a radius of 30 km from a population centre of at least 40,000 people) for at least six consecutive months. A special work site is one where you worked temporarily while your principal place of residence (house or apartment) was at another location. Because of the distance between the two areas, you were not expected to return daily from the work site to your home.

If you lived at a special work site, your employer or the principal contractor of your project (like the Société d’énergie de la Baie James) might have provided you a tax-exempt benefit for boarding and lodging. If so, your residency amount is reduced by the tax-exempt benefits you received for board and lodging. You can find these amounts in box 31 of your T4 slip or box 124 of your T4A slip, and/or box V-1 of your RL-1 slip.

Note: If your principal place of residence was located in a northern or intermediate zone while you were employed on a special work site, you don’t need to enter the value of the tax-exempt benefits on the T2222/TP-350.1 page.

You can claim the travel benefits deduction (or travel deduction, if you’re a Québec resident) if you worked in a prescribed zone during 2019 and paid for travel or for the value of travel provided by your employer. To qualify, you must meet the following requirements:

- You qualify to claim the northern residents deductions

- You’re an employee who deals at arm’s length with your employer (in other words, you’re not related)

- You’ve included your taxable travel benefits in your income for the same year that you took your trip

The most you can deduct from each eligible trip is the lowest amount out of:

- The taxable travel benefits you received from your employer for the trip

- The total travel expenses you paid for the trip

- The cost of the least expensive return flight (lowest return airfare*) available when you took the trip between the airport closest to where you live and where you were going (nearest designated city)

You can’t claim the deduction, if you took a trip that began and ended in the year and you were reimbursed in the following year for that trip.

Notes:

- Taxable travel benefits include:

- travel assistance provided by your employer such as airline tickets and

- a travel allowance or a lump-sum payment you received from your employer for travel expenses you paid.

- Travel expenses include air, train, or bus fares, vehicle expenses, meals, hotel or motel accommodations, camping fees, and other incidentals such as taxis and highway or ferry tolls.

- Lowest return airfare is the lowest airfare that's available for regularly scheduled commercial flights between the airport closest to where you live and where you’re going (nearest designated city), excluding promotions or discounts that aren't normally available, on the date that the travel began. It also includes any GST/PST/HST and airport taxes. Additional charges, such as flight cancellation insurance, meals, and baggage surcharges aren't considered part of the lowest return airfare. Nearest designated cities are limited to Vancouver, Edmonton, Calgary, Saskatoon, Winnipeg, North Bay, Toronto, Ottawa, Montréal, Québec, Moncton, Halifax, and St. John’s (NL).

- If you’re claiming these benefits for another member of your household, they must have been living with you at the time they travelled. If you’re a Québec resident, don’t include members of your household for whom you’re claiming the amount for dependants and amount transferred by a child 18 or over enrolled in post-secondary studies.

You can claim a deduction for travel benefits for a trip that you or your household members (who lived with you at the time of the trip) took for vacation, family, or medical reasons. The trip must have started from a prescribed zone.

If you travelled for medical reasons, you can claim a deduction if there is an amount in box 33 of your T4 slip, box 116 of your T4A slip, or box K-1 of your RL-1 slip. These amounts are the value of the taxable travel benefits you received in the year. These medical services must not have been available where you lived. The number of trips you can claim for medical reasons, is unlimited.

Note: If you’re claiming a deduction for medical travel on the T2222 (and/or TP-350.1-V) form, no one can claim it as a medical expense on their return.

If you travelled for other reasons (vacation or family), you can claim a deduction if you have an amount in box 32 of your T4 slip, box 28 of your T4A slip, or box K of your RL-1 slip (with no amount in box K-1 or only a portion of the amount in box K shown in box K-1). These amounts are the value of the taxable travel benefits you received in the year. You can claim a maximum of two trips per year for other travel for yourself and for each member of your household. If you received benefits for more than two trips in the year, you can choose the two trips you want to claim on this form.

To determine the taxable travel benefits you received for other travel, you can use this formula:

A – B = C

where:

A = Taxable travel benefits received for other travel i.e. box 32 of your T4 slip, or box 28 of your T4A slip, or box K of your RL-1 slip

minus

B= Taxable travel benefits received for medical travel i.e. box 33 of your T4, box 116 of your T4A, or box K-1 of your RL-1 slip

Note: If you received a benefit that wasn’t for any specific trip, you’ll need to split it reasonably between the trips you are claiming.

Yes. If you’re travelling for a valid medical reason and you require attendant care while travelling, you can claim your attendant’s travel expenses along with your own. For more information, refer to the CRA website.

When it comes to calculating the meal and vehicle expenses related to your travels, you can use either the detailed or simplified method of reporting, as long as your total travel expenses equals the combined total of the travel assistance provided by your employer and the expenses that you incurred and paid for yourself.

Detailed method: Using the detailed method of reporting expenses allows you to claim the actual amount that you spent. Of course, this means that you’ll need to keep each receipt to validate your expenses.

Simplified method: Using the simplified method, a flat rate is used to calculate your daily meal and vehicle expenses. Even though you aren’t required to keep all of your receipts when using the simplified method, you should still hang onto documentation that can support your claim(s).

- Meals: Claim a flat rate of $17/per meal (up to $51/day including tax, per person). These can be claimed in either Canadian or U.S. funds.

- Vehicle expenses: Record the kilometres driven during the tax year for the trip. To figure out the amount you’re allowed to claim on your return, simply multiply the number of kilometres driven with the cents/km rate assigned to the province or territory where your travels began. Check out the CRA website for the rate that applies to you.

If you recently moved and haven’t yet lived in a prescribed zone for 6 consecutive months, you can file your return without claiming your deductions; when you do qualify, you can adjust your return using the H&R Block tax software’s ReFILE feature. You can also request the CRA for an adjustment.

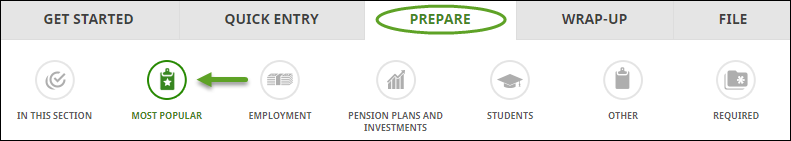

Follow these steps in H&R Block’s 2019 tax software:

- On the PREPARE tab, click the MOST POPULAR icon. You’ll find yourself here:

- Under the DEDUCTIONS heading, select the checkbox labelled Northern residents deductions for 2019 (T2222), then click Continue. If you're a Québec resident, select the checkbox labelled Calculation of the deduction for residents of designated remote areas (T2222 & TP-350.1-V), then click Continue.

- When you arrive at the page for the Northern residents deductions, enter your information into the tax software.