What is ReFile?

ReFILE enables filers who have already submitted their returns to adjust and re-file a return to the Canada Revenu Agency (CRA), without submitting any paper forms. ReFILE is quick, efficient (no postage or paper required), and simple, and it is available in H&R Block’s 2019 tax software.

Note: To refile your return electronically, your original return must have been filed through NETIFLE and you have to wait until you’ve received your notice of assessment from the Canada Revenue Agency (CRA) if you need to make any changes.

Some of the most common scenarios where you might want to ReFILE your return are:

- You got a late slip (e.g. RRSP contribution slip) that you did not include in your original return

- You forgot to include a source of income in your original return

- You forgot to claim a deduction or credit that you are entitled to

Note: You cannot use ReFILE to make any adjustments to your personal information (changed marital status, changed address, etc.); it can only be used to adjust a filed tax return (e.g. missed reporting income, forgot to include a slip, etc.).

You can use the ReFILE service to amend your 2019, 2018, and 2017 tax returns. However, you’ll need to use the H&R Block tax software for the specific year the return belongs to. For example, to ReFILE your 2019 tax return, you can only use the 2019 H&R Block tax software.

Yes! If you need to amend your Québec return (TP-1), you can use the ReFILE functionality within H&R Block’s 2019 tax software to adjust and submit your return electronically. Keep in mind, in order to ReFILE your return, you must have submitted your original CRA and Revenu Québec returns through NETIFLE. You also have to wait until you’ve received your notice of assessment before you can ReFILE your return.

You can also choose to print out the adjusted return and mail it to Revenu Québec.

Follow these steps in H&R Block's 2019 tax software:

- On your Dashboard, OPEN the return that you want to adjust.

- When you make a change to a slip, form, or field in your return, you will see a pop-up asking if you want make changes to a return that has already been filed. To confirm that you want to make changes to your return, click Yes, Change My Return.

Remember: You can’t make changes to your personal information with ReFILE.

- In the Making changes to your 2019 return window, click Start Making Changes.

- Make changes to your return as required.

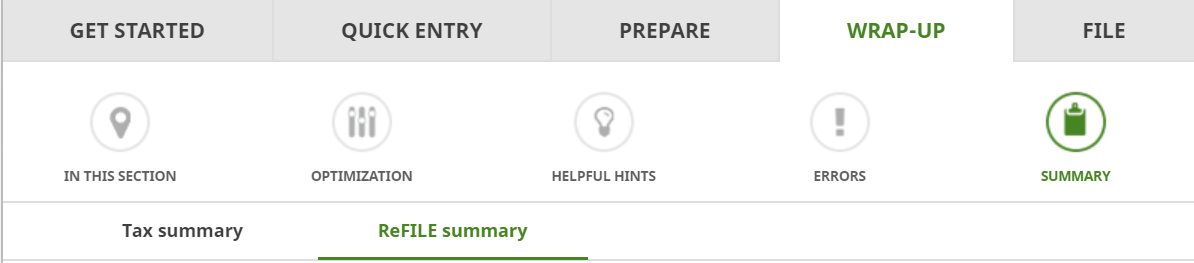

- When you arrive on the SUMMARY page under WRAP-UP, click ReFILE Summary to see how your changes have impacted your return.

- When you’re ready, click ReFILE Now on the FILE tab to submit your amended return.

Note: If you’re adjusting a Québec return, before you ReFILE, you might have to answer some questions from Revenu Québec about why you amended your return.

If you ReFILE’d your 2019 return, but then see a mistake in the ReFILE’d copy that you need to fix, you will need to complete a second ReFILE after you amend your return. To do this:

- Log into H&R Block’s 2019 tax software.

- On the Dashboard, click Edit for ReFile next to the return you want to amend.

- Follow steps 2 to 6 in the section How do I ReFILE my 2019 tax return in the software?.

- ReFILE: Online adjustments for income tax and benefit returns (CRA website)

- Request for an adjustment to an income tax return (Revenu Québec website)