Statement of employment expenses (T777 and TP-59)

If you’re an employee and your employer requires you to pay for certain expenses as a condition of your employment, you can use the T777: Statement of employment expenses form to claim these expenses on your tax return. If you’re a resident of Québec, you will also need to complete a TP-59-V: Employment expenses of salaried employees and employees who earn commissions form to claim your employment expenses. Fortunately, the T777 and TP-59 forms are combined in H&R Block's tax software.

Notes:

- You can’t claim expenses that were reimbursed by your employer or personal expenses such as those paid to travel to and from work or for most tools and clothing.

- Be sure to keep records for each year you claim employment expenses in case the Canada Revenue Agency (CRA) or Revenu Québec asks to see these later. These include:

- a daily record of your expenses, together with your receipts and any cancelled cheques

- any ticket stubs for travel

- any invoices and monthly credit card statements

- a record of each motor vehicle you used for employment with the total kilometres you drove and the kilometres you drove for employment purposes.

- a record of musical instruments you bought and sold (if applicable) since you might be able to claim capital cost allowance (CCA)

In order to claim employment expenses, you must have a completed and signed T2200: Declaration of conditions of employment form from your employer indicating the expenses you were required to pay as part of your conditions of employment.

If you are also filing a Québec return, your employer will need to give you a completed and signed copy of one or more of the following forms:

- If you’re a salaried employee or an employee earning commissions - form TP-64.3-V (General Employment Conditions) to claim a deduction for motor-vehicle expenses and travel expenses, cost of supplies, expenses related to an office in the home and other expenses, and a few others.

- If you’re a salaried musician - form TP-64.3-V (General Employment Conditions) to claim a deduction for employment expenses other than the ones related to your musical instrument.

- If you’re a salaried tradesperson, such as hairdresser, cook, plumber, apprentice mechanic, etc. - form TP-75.2-V (Employment Expenses of Salaried Tradespeople) to claim deductions for your eligible tools.

- If you’re a forestry worker - form TP-78-V (Employment Expenses of Forestry Workers) to claim a deduction for chain-saw or brush-cutter expenses, snowmobile or all-terrain-vehicle (ATV) expenses, or motor-vehicle expenses.

Note: Be sure to keep the signed form(s) and any receipts and records in case the CRA or Revenu Québec asks for them later.

You can deduct certain expenses you paid to earn employment income or commissions, provided you were required to pay for these expenses under a contract of employment.

Keep in mind, if you earn commission income, you’ll need to meet the following employment conditions in order to deduct expenses:

- You had to pay your own expenses under a contract of employment.

- You were normally required to work away from your employer's place of business.

- You were paid in whole or in part by commissions or similar amounts. These payments were based on the volume of sales made or the contracts negotiated.

- You didn’t receive a non-taxable allowance for travelling expenses. Generally, an allowance is non-taxable as long as it’s a reasonable amount. For example, an allowance for the use of a motor vehicle is usually non-taxable when it’s based solely on a reasonable per-kilometre rate.

- You have a copy of form T2200: Declaration of Conditions of Employment, which has been completed and signed by your employer.

Your employment expenses can include any GST/HST and provincial tax you paid on them. You might be able to claim a GST/HST rebate on these. Click here for more information.

- Accounting and legal fees - You can deduct legal fees you paid in the year to collect (or establish a right to collect) salary, wages, or other amounts that need to be reported as employment income. However, you’ll need to reduce your claim by any reimbursements or amounts that were awarded to you for your legal expenses. If you earn commission income, you can also deduct reasonable accounting fees for help in preparing and filing your tax return.

- Advertising and promotion - If you earn commission income, you can deduct advertising and promotion expenses such as amounts you paid for business cards, promotional gifts, newspaper ads, and radio and TV advertisements.

- Meals and beverages - As a salaried or commissioned employee, you can deduct the cost of food and beverage expenses if your employer required you to be away for at least 12 consecutive hours from the municipality and the city (if applicable) of the location where you normally report for work. The most you can deduct is 50% of the lesser of:

- the amount you paid and

- an amount that is reasonable in the circumstances

The 50% limit also applies to the cost of food and beverages you paid for when you travelled on an airplane, train, or bus, as long as the ticket price did not include these amounts. If earn commission income, you can also claim entertainment expenses such as tickets and entrance fees to entertainment and sporting events. The 50% rule applies to entertainment expenses too.

- Lodging - If your work required you to travel away from your employer's place of business and you paid for your own stay in a hotel or motel, you can deduct these amounts.

- Parking - You can deduct parking costs related to earning your employment or commission income if you meet the conditions listed in the I used my vehicle to earn employment income section below. Generally, you can’t deduct the cost of parking at your employer's office, such as monthly or daily parking fees or the cost of traffic infractions such as speeding tickets. These are personal costs.

- Supplies - Supplies include stationery items, stamps, envelopes, cost of postage, toner, ink cartridges, street maps, and directories. You can deduct these expenses only if you paid for these supplies or if your employer reimbursed you for purchasing these supplies and included these amounts in your income for the year.

Note: Supplies don’t include items such as briefcases or calculators. You also can’t deduct the cost of special clothing that you wear to work or tools that are considered equipment unless you’re a tradesperson (see the I am an employed tradesperson section below).

- Other expenses - You can deduct several other expenses such as any licencing fee that you paid to do your work, salary paid to an assistant or a substitute, office rent to earn commission income, and training costs. Refer to the Canada Revenue Agency (CRA) website for a full list of other expenses that can be deducted from your employment income.

You can deduct expenses you paid for the employment use of a work space in your home if you meet one of the following conditions:

- The work space is where you typically (more than 50% of the time) do your work.

- You use the work space only to earn your employment income. You also have to use it on a regular and continuous basis for meeting clients, customers, or other people to meet your employment duties.

If you’re a salaried employee, you must have paid these expenses under your contract of employment to be used directly in your work. You must also not have received reimbursement from your employer for these expenses.

You can deduct the part of your costs that relates to your work space such as the cost of:

- electricity

- heating

- maintenance

Note: If you’re a salaried employee, you can’t deduct mortgage interest, property taxes, home insurance, or capital cost allowance. If you’re on commission, you can deduct your property taxes and home insurance costs.

To calculate the percentage of home office expenses you can deduct, use a reasonable basis, such as the area of the work space divided by the total finished area (including hallways, bathrooms, kitchens, etc.) of your home.

If your office space is in a rented house or an apartment where you live, deduct the percentage of the rent as well as any maintenance costs you paid that relate to the work space.

Keep in mind, the amount you can deduct for home office expenses is limited to the amount of employment income remaining after all other employment expenses have been deducted. This means that you can’t use home office expenses to create or increase a loss from employment.

You can carry forward any unused home office expenses and claim them in the following year, as long as you’re reporting income from the same employer. You can find your unused expenses’ amount on your previous year’s T777 form.

Refer to the I used my vehicle to earn employment income section below.

If you’re an employee of a transport business (such as an airline or trucking company), railway company, etc., in addition to the employment expenses for salaried employees, you can claim the cost of meals and lodging (including showers). You’ll need to claim your employment expenses on the TL2: Claim for meals and lodging expenses form.

Note: Your employer will need to complete part 3 of the TL2 form.

Click here for more information on claiming your transport employment expenses.

If you earned employment income from an artistic activity, you can deduct expenses you paid if you did any of the following:

- composed a dramatic, musical, or literary work

- performed as an actor, dancer, singer, or musician in a dramatic or musical work

- performed in an artistic activity as a member of a professional artists' association that the Minister of Canadian Heritage has certified or

- created a painting, print, etching, drawing, sculpture, or similar work of art (reproduction of these is not considered an artistic activity)

These expenses can include any GST and provincial sales tax (PST) or HST that you paid. You might be able to claim a rebate on the GST/HST you paid.

The amount you can claim is the lesser of:

- the expenses you actually paid in the year and

- the lesser of:

- $1,000 and

- 20% of your employment income from artistic activities

minus the following amounts you deducted from your income from an artistic activity:

- musical instrument expenses

- interest for your motor vehicle and

- capital cost allowance for your motor vehicle

If you have expenses that you can’t claim this year because of the limit, you can deduct them from artistic income you earn in a future year. Also, you can deduct amounts you carried forward from previous years from your artistic income earned in 2019, as long as the total expenses are within the above limits for the year.

If you’re an employed musician, your employer might require you to provide your own musical instrument. If this is the case, you can deduct the expenses you paid related to the musical instrument.

Although you can’t deduct the actual cost of your musical instrument, the amounts you can deduct for your musical instrument are:

- maintenance costs

- rental fees

- insurance costs and

- capital cost allowance (if you own the instrument)

If you use your musical instrument for your employment and other purposes, you’ll need to divide the total instrument expenses based on the different uses. Click here for more information on calculating your musical instrument expenses.

You might be able to deduct the cost of eligible tools you bought during the year to earn employment income as a tradesperson (hairdresser, plumber, apprentice mechanic, etc.). These expenses can include any GST and provincial sales tax (PST) or HST that you paid. You might be able to claim a rebate on the GST/HST you paid.

An eligible tool is a tool (including associated equipment such as a toolbox) that:

- you bought to use for your job as a tradesperson and was not used previously

- your employer certified that it was necessary as a condition of and for use in your job as a tradesperson and

- is not an electronic communication device (like a cell phone) or electronic data processing equipment (unless the device or equipment can be used only for the purpose of measuring, locating, or calculating)

The maximum deduction you can claim for eligible tools is the lesser of $500 and the amount calculated by the following formula:

A −

A = the lesser of:

- the total cost of eligible tools that you bought in 2019 and

- your income from employment as a tradesperson for the year

plus the amount you received in 2019 under the Apprenticeship Incentive Grant and the Apprenticeship Completion Grant programs minus the amount of any Apprenticeship Incentive Grant and Apprenticeship Completion Grant overpayments that you had to repay in 2019.

Note: If you’re an employed apprentice mechanic, refer to CRA’s Employment Expenses’ guide for information on deducting the cost of eligible tools. If you’re an apprentice mechanic in Québec, refer to Revenu Québec’s guide, Employment Expenses and check out this link.

If you work in forestry operations, you can deduct expenses you paid for buying and using a power saw (including a chain saw or tree trimmer) if you meet all of the following conditions:

- You use a power saw to earn your employment income

- You paid for the power saw under your contract of employment and your employer did not (and will not be) reimbursing you

You can deduct the cost of a power saw in the year you buy it, but you’ll need to subtract from the purchase price, the value of any trade-in or the amount you received from the sale of any power saw during the year.

You can also claim the cost of motor vehicle expenses provided these are not for travel from your home to the place you report for work on a regular basis. Refer to the I used my vehicle to earn employment income section below for more information.

You can deduct the expenses you paid related to the motor vehicle you used to earn employment income, provided these aren’t costs paid for regular travel between home and work.

If you’re a salaried employee or one that earns commission income, you can claim vehicle expenses as long as you meet all of these conditions:

- You’re normally required to work away from your employer's place of business or in different places.

- Under your contract of employment, you had to pay your own motor vehicle expenses.

- You aren’t considered to have paid your own motor vehicle expenses if your employer reimburses you or you refuse a reimbursement or reasonable allowance from your employer.

- You didn’t receive a non-taxable allowance for motor vehicle expenses such as per-kilometre rate.

- You have a copy of form T2200, which has been completed and signed by your employer.

These expenses can include any GST and provincial sales tax (PST) or HST that you paid. You might be able to claim a rebate on the GST/HST you paid.

If you use your personal car for employment and personal use, you can only deduct the portion of expenses that are related to earning employment income. Expenses that can be deducted include:

- fuel (such as gasoline, propane, and oil)

- maintenance and repairs

- insurance

- licence and registration fees

- capital cost allowance (CCA)

- interest you paid on a loan used to buy the motor vehicle

- eligible leasing costs

Rebates, reimbursement, or an allowance - If you received a reimbursement, rebate, or an allowance for any of your vehicle expenses that weren’t included in your employment income, you’ll need to report those amounts on the T777 page. Don’t include any amounts that were repayments related to leasing costs. Certain leasing costs can be deducted from your income using this chart. However, if you have repayments that are owed to you, you won’t be able to use this chart to calculate the leasing costs; instead you’ll need to contact the CRA.

Calculating the interest on your vehicle loan - You can deduct interest you paid on money you borrowed to buy a motor vehicle or passenger vehicle you use to earn employment income.

If you use a passenger vehicle to earn employment income, there is a limit on the amount of interest you can deduct. It is the lower of the following:

- Total interest paid in the year

- $10* multiplied by the number of days for which interest was paid

*Use $8.33 for passenger vehicles purchased between December 31, 1996, and January 1, 2001. In all other cases, use $10.

Note: Be sure to keep a record for each vehicle you used. The record should include the kilometres you drove to earn employment income and total kilometres, dates traveled, destination, and purpose. Additionally, keep a record of the odometer reading at the beginning and end of the year.

Generally, you can’t deduct the entire cost of a property (such as vehicle or a musical instrument) you used to earn income. However, you can claim a percentage of the property’s cost known as depreciation or capital cost allowance (CCA).

You can claim CCA on your vehicle or musical instrument if you’re:

- An employee earning commission income and you meet all of the employment conditions

- A salaried employee and you meet all the conditions provided here

- An employed musician and you had to provide the musical instrument as a condition of your employment

The amount of CCA you can claim for your depreciable property depends on the class that property belongs to and its CCA rate. Refer to the CRA website to find out which class your vehicle or musical instrument belongs to.

Keep in mind, you don’t have to claim the maximum amount of CCA in any given year. You can claim any amount you want, from zero up to the maximum allowed for the year.

Important: If you sell your vehicle during the year, depending on the class, you might not be able to claim CCA on it.

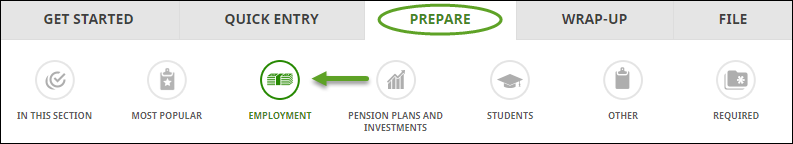

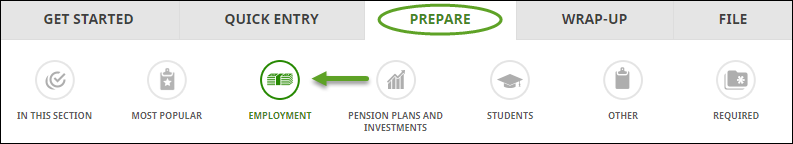

To claim CCA for the vehicle you used to earn employment income, follow these steps in H&R Block’s 2019 tax software:

- Under the PREPARE tab, click the IN THIS SECTION icon.

- Under Employment Expenses box, click the Add This Topic button.

- Click the EMPLOYMENT icon. You'll find yourself here:

- Under the EXPENSES heading, select the checkbox labelled Employment expenses then click Continue.

- On the Employment Expenses page, answer Yes to the question, Do you have motor vehicle expenses to claim?.

- Return to the top of the page. Select Vehicle expenses from the green Go To Page dropdown menu. Answer Yes to the question Do you want to claim capital cost allowance for this vehicle?

- Enter your information into the tax software.

- What was the Undepreciated capital cost balance at the start of 2019? – If you claimed CCA in any previous year, you’ll need to enter the undepreciated capital cost (UCC) of the property at the end of last year on the T777 page. UCC is the amount of the capital cost left for further depreciation at any given time. If you received a GST/HST rebate for a vehicle or musical instrument in 2019, you’ll need to reduce your opening UCC by the amount of the rebate.

- What’s the total cost of any additions you made to this vehicle or musical instrument in 2019? – This is the amount you paid for the vehicle or musical instrument including any GST/HST or provincial sales tax and costs you paid to improve the vehicle or instrument.

- If you disposed of this vehicle or instrument in 2019, what were your proceeds of disposition? Enter the lowest amount: the amount you received for the vehicle/instrument or the original cost - Also, include any insurance proceeds for a property that was lost or destroyed that are more than the cost of the property.

Follow these steps in H&R Block’s 2019 tax software:

- Under the PREPARE tab, click the IN THIS SECTION icon.

- Under Employment Expenses box, click the Add This Topic button.

- Click the EMPLOYMENT icon. You'll find yourself here:

- Under the EXPENSES heading of the Employment & self-employment page, select the checkbox labelled Statement of employment expenses then click Continue.

- When you arrive at the Employment expenses page, enter your information into the tax software.