TL2: Meals and lodging for long-haul truck drivers

This deduction allows employees of a transport business (such as truck drivers or railway employees) to reduce their total income by claiming their meal, lodging, and/or shower expenses paid (including any GST and HST you paid) while working away from home.

Note: You can’t deduct the cost of travel to and from work or other expenses such as, most tools and clothing.

If your employer pays a portion of your expenses through a non-taxable allowance or reimbursement, you’ll only be able to claim the amount that you paid out of pocket.

When deducting your meals, lodging and/or shower expenses, be sure to keep a detailed list of your trips and keep all of your receipts in case the Canada Revenue Agency (CRA) requests to see them.

Note: If you’re a resident of Québec, you’ll also need to complete TP-66-V: Employment Expenses of Transport Employees.

You must meet all of the following conditions in order to be eligible for this credit:

- You work for an airline, railway, bus, or trucking company, or for any other employer whose main business is transporting goods, passengers, or both

- You travel in vehicles your employer uses to transport goods or passengers

- You regularly have to travel away from the municipality and the metropolitan area (if there is one) where your employer is primarily located

- You regularly incur meal and lodging expenses while traveling away from the municipality and the metropolitan area (if there is one) where your employer is primarily located. This means that you must generally be away from home overnight in order to do your job.

Usually, the most you can deduct for a meal is 50% of its cost. You can only claim the cost of one meal every 4 hours up to a maximum of 3 meals in a 24-hour period. To calculate the deduction for your meals, you can use the simplified, detailed, or the batching method.

Tax tip: Before you decide which method to use, compare how much you’ll be able to claim using each method. You might be able to claim more with one method over the others.

If you’re a long-haul truck driver, you can take advantage of a much higher meal deduction rate of 80%. This is because long-haul drivers regularly travel outside of their municipality (at least 160 km) to transport goods or passengers for long periods of time (at least 24 hours).

Note: If you made trips to the United States (US), be sure to convert your meal expenses to Canadian dollars by multiplying the amounts by the Bank of Canada annual average exchange rate.

As a transportation employee, you can deduct your lodging expenses and the cost of showers (if you slept in the cab of your truck rather than at a hotel). Be sure to keep your receipts to support the amount you’re deducting.

Yes. If you’re going to be claiming the cost of meals and lodging that you had to pay as a long-haul truck driver on your 2019 tax return, you’ll need to get your employer to fill out part 3 of form TL2. You can download and print a copy of the TL2 on the CRA's website.

Some of the information your employer will be asked to provide includes:

- The name of the collective agreement that governs your employment with the company

- The cost of subsidized meals that were made available to you

- The amount of allowance or repayment that you received for meals and lodging in 2019 (if applicable)

Once your employer has completed part 3 of this form, you can use this information to complete the TL2 page in H&R Block’s tax software. Make sure you keep a copy of the document your employer filled out for you with your records.

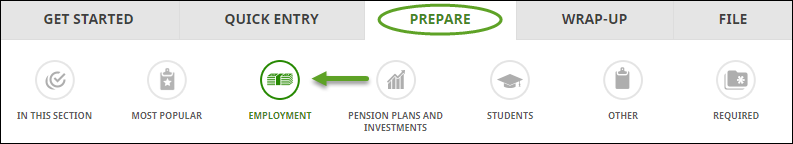

Follow these steps in H&R Block’s 2019 tax software:

- Under the PREPARE tab, click the IN THIS SECTION icon.

- Under Employment Expenses box, click the Add This Topic button.

- Click the EMPLOYMENT icon. You'll find yourself here:

- Under the EXPENSES heading, select the checkbox labelled Claim for meals and lodging expenses (TL2), then click Continue.

- When you arrive at the page for your Meals/lodging expenses, enter your information into the tax software