How can I transfer my unused federal tuition amounts to my spouse, common-law partner, or relative?

Before you can transfer any of your federal tuition amounts to an eligible family member, you must first figure out how much of a credit is available to you, as well as the amount you’ll need to reduce your own federal tax payable. H&R Block’s tax software calculates these amounts for you once you’ve entered the information from your from your tax certificate (such as a T2202, TL11A, or TL11C) into the software.

Once you’ve used your tuition amounts to reduce your own federal (and provincial) tax payable, you can choose to transfer any remaining amounts to one of following people:

- Your spouse or common-law partner

- Your parent or grandparent or

- Your spouse’s or common-law partner’s parent or grandparent

Note: You can’t transfer tuition (and education and textbook) credits that have been carried forward from a previous year; only current year tuition amounts can be transferred.

When transferring these amounts to an eligible family member, be sure to complete the transfer section of your tax certificate and provide a copy to the person receiving the transfer amount.

Things to keep in mind:

- If your spouse is claiming the spousal (or common-law partner) amount on your behalf, your spouse is the only person you can transfer your unused tuition amounts to.

- If you’re transferring both your unused federal and provincial tuition amounts, they must be transferred to the same person.

- The maximum credit amount that can be transferred is $5,000 less any amount you used on your own return.

Follow these steps in H&R Block’s 2019 tax software:

If you indicated that your marital status was single, divorced, separated, or widowed:

- On the WRAP-UP tab, click the OPTIMIZATION icon.

- Click the Claimed credits link.

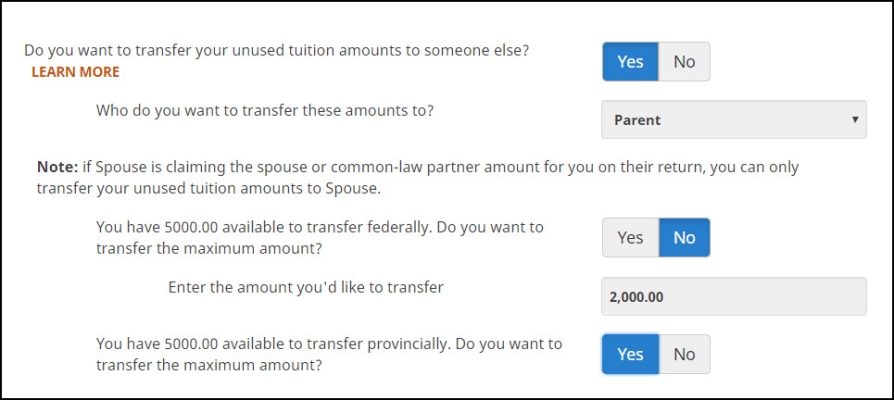

- Select Yes in response to the question, Do you want to transfer your unused tuition amounts to someone else?.

- From the drop-down menu, select the person you wish to transfer these amounts to.

Note: If you don’t want to transfer the maximum amount, you’ll need to indicate how much of your unused amounts you’d like to transfer.

If you are preparing your return separate from your spouse:

- On the WRAP-UP tab, click the OPTIMIZATION icon.

- Click the Claimed credits link.

- Select Yes in response to the question, Do you want to transfer your unused tuition amounts to someone else?.

- From the drop-down menu, select the person you wish to transfer these amounts to.

Note: If you don’t want to transfer the maximum amount, you’ll need to indicate how much of your unused amounts you’d like to transfer.

If you are preparing your return with your spouse (coupled return):

- On the WRAP-UP tab, click the OPTIMIZATION icon.

- Click on the Optimized credits link. You will be able to see the optimized unused tuition amount that is available for transfer to your spouse.

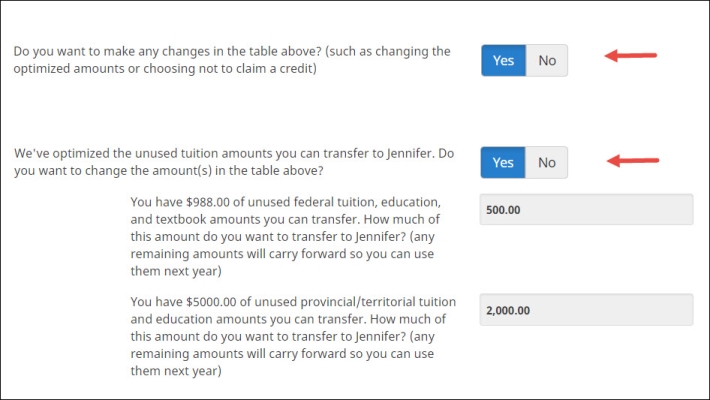

- Select Yes to the question, Do you want to make any changes in the table above? (such as changing the optimized amounts or choosing not to claim a credit).

- Select your response to the question, We've optimized the unused tuition amounts you can transfer to Spouse. Do you want to change the amount(s) in the table above?. You can transfer the optimized amount shown in the table or specify how much of the available amount you want to transfer.

- Click the Optimize again button to update your return with the changes.