Ontario Apprenticeship Training Tax Credit or the Ontario Co-operative Education Tax Credit

As an employer in Ontario, you can claim the following provincial tax credits for your apprentices or co-op students.

Note: The Ontario apprenticeship training tax credit cannot be claimed for those programs in which the training agreement or contract of apprenticeship was registered after November 14, 2017. You can only claim expenses for apprenticeship programs that started before November 15, 2017.

If your unincorporated business hires and trains apprentices in skilled trades, you can claim the apprenticeship training tax credit to help you pay for the cost to train them.

Apprenticeships that started after April 23, 2015 and before November 15, 2017, qualify for the tax credit for the first 36 months of their program. Apprenticeships that started before April 23, 2015, are eligible to claim the credit for the first 48 months.

The credit amount is based on the salary and wages you paid to the apprentice. Businesses can claim 25% of eligible expenses, up to a maximum of $5,000 per year for each apprenticeship ($15,000 over the first 36-month period) that started after April 23, 2015 and before November 15, 2017. For apprenticeships that started on or before April 23, 2015, you can claim $10,000 per year.

To qualify for the tax credit, the apprenticeship has to meet the following conditions:

- The apprenticeship must be of a qualifying skilled trade as per the Ontario minister of Advanced Education and Skills Development and designated by the Ontario minister of Finance

- The apprenticeship training agreement must have been registered under the Ontario College of Trades and Apprenticeship Act, 2009 or a predecessor of that act

If you hired students enrolled in a co-op program at an Ontario university or college, you can claim a tax credit to help you pay for their salaries. With the co-operative education tax credit, you can claim up to $3,000 for each work placement. Most work placements are between 10 weeks to 4 months.

Make sure your student’s school provides you with a letter of certification for their placement.

Follow these steps in H&R Block’s 2019 tax software:

- Before you begin, make sure you told us that you lived in Ontario on December 31, 2019.

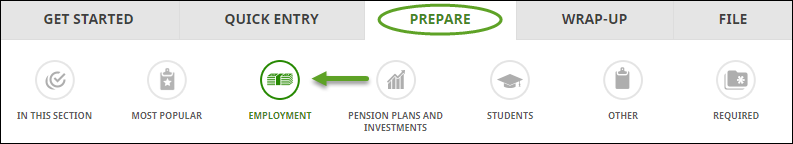

- Under the PREPARE tab, click the IN THIS SECTION icon.

- In the Self-employment income and expenses, click the Add This Topic button.

- Click the EMPLOYMENT icon. You'll find yourself here:

- Under the CREDITS AND REBATES heading, select the checkbox labelled Ontario tax credits for self-employed individuals, then click Continue.

- When you arrive at the page for the Ontario tax credits for self-employed individuals, enter your information into the tax software.