TP-726.7-V: Capital Gains Deduction on Qualified Property

You can claim a capital gains deduction on the TP-726.7-V form if you realized capital gains when you disposed (sold or transferred) your qualified property:

- qualified farm or fishing property or qualified small business shares disposed of in 2019

- qualified farm or fishing property or qualified small business shares disposed of before 2019 and for which a reserve was claimed in 2019

- qualified farm property or qualified fishing property disposed of before 2014 and for which a reserve was claimed in 2019

You can also use this form if you haven’t reached the capital gains deduction limit and want to report a gain from selling incorporeal capital property (such as goodwill, a trademark, or a farm quota) that was qualified farm or fishing property.

Note: You’ll need to also complete the federal T657: Calculation of Capital Gains Deduction form.

If you sold resource property (such as flow-through shares) that resulted in capital gains, then you can calculate your deduction by using form TP-726.20.2-V: Capital gains deduction on resource property.

You can claim this deduction if you realized capital gains on the disposition of qualified property and you’re a Canadian resident. For the purposes of the capital gains deduction, Revenu Québec considers you to be a Canadian resident if you lived in Canada throughout 2019, for part of 2019 and throughout 2018, or you expect to be a resident throughout 2020.

Your deduction depends on the amount you claim on your federal income tax return. If you claim an amount that’s less than what you’re entitled to, you need to claim the same amount on your Québec return, as long as it’s less than the maximum amount you’re entitled to for provincial tax purposes.

Keep in mind, your cumulative net investment loss (CNIL) as on December 31 might reduce your capital gains deduction. Your CNIL is equal to the investment expenses you’ve paid after 1987, minus the investment income you earned after 1987. To calculate your CNIL, complete form TP-726.6-V: Cumulative net investment loss to calculate your CNIL.

Follow these steps in H&R Block’s 2019 tax software:

Before you begin, make sure you told us that you lived in Québec on December 31, 2019.

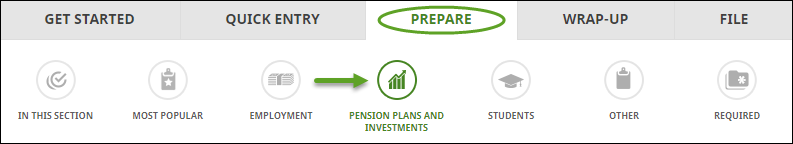

- On the PREPARE tab, click the IN THIS SECTION icon.

- In the Investments box, click the Add This Topic button.

- Click the PENSION PLANS AND INVESTMENTS icon. You’ll find yourself here:

- Under the BOUGHT/SOLD SECURITIES OR OTHER PROPERTY, select the checkbox labelled Capital gains deduction on qualified property (TP-726.7-V), then click Continue.

- When you arrive at the page for the Capital gains deduction, answer Yes to the question Would you want to claim the capital claims deduction?.

- Enter your information into the tax software.