Accelerated refund on your Québec return

You can ask to receive a refund on your Québec return even before it’s processed by Revenu Québec. If you receive an accelerated refund, remember that your refund amount might change after your return has been assessed.

You can ask for an accelerated refund if all of the following situations apply to you.:

- You’re claiming $3,000 or less for your refund

- You filed an income tax for the previous tax year

- You haven’t changed your name or social insurance number since your 2018 tax return

- You don’t owe anything to Revenu Québec or any other government body

- You don’t owe anyone support payments

- You didn’t declare bankruptcy, or file a proposal in bankruptcy or a consumer proposal after 2018

- You aren’t transferring your refund to your spouse

- You’re filing your 2019 income tax return before the deadline

Keep in mind, it might take Revenu Québec a little longer to issue your notice of assessment (NOA) if your refund is accelerated. It might also take longer for Revenu Québec to share your information with other government departments, like with financial assistance for students or childcare, if you’ve authorized Revenu Québec to do so.

If you received an accelerated refund and you receive an NOA stating you have a balance due (because you’re being refunded less than you originally thought), you might need to pay interest on the amount you owe.

Note: Revenu Québec can refuse your request for an accelerated refund.

To request an accelerated refund in H&R Block’s 2019 tax software, follow these steps:

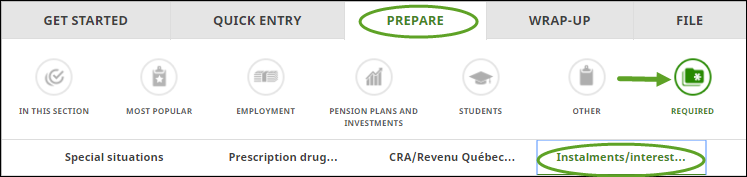

- Under the PREPARE tab, click the REQUIRED icon.

- Navigate to the Instalments/interest received/direct deposit page. You’ll find yourself here:

- Under the Accelerated refund section, select Yes in response to the question If you get a refund for your Revenu Québec return, do you want to receive your refund before your return is processed?.