Zero-emission vehicles (ZEV)

In 2019, the Canadian government introduced several incentives to make purchasing new eligible zero-emission vehicles (ZEV), also called electric cars, more affordable.

A ZEV can be any of these:

- Battery-electric — runs on electricity

- Plug-in hybrid electric — combines a gas-powered engine with a battery that recharges by plugging it into an electric source

- Hydrogen fuel cell — powered by an electric motor that runs on electricity created by an on-board fuel cell

If you are thinking of purchasing or have purchased a new eligible ZEV, the federal Incentives for Zero-Emission Vehicles (iZEV) Program, offers the following incentives to consumers and businesses:

- purchase or lease point-of-sale incentives

- enhanced capital cost allowance deduction

Important: You can only receive one of the two incentives offered by the program. If you received a point-of-sale incentive, you can’t claim the enhanced capital cost allowance deduction.

The iZEV federal purchase or lease incentives are:

- $5,000 for a battery-electric, hydrogen fuel cell, or longer range plug-in hybrid vehicles (battery capacity is 15 kWh or more)

- $2,500 for a shorter range plug-in hybrid electric vehicle (battery capacity is less than 15 kWh)

To be eligible, the ZEVs must be:

- A vehicle with 6 seats or less where the base model Manufacturer’s Suggested Retail Price (MSRP) is less than $45,000 or

- A vehicle with 7 seats or more, where the base model MSRP is less than $55,000

Note: Higher price versions of these vehicles will also be eligible as long as the MSRP is not more than $55,000 and $60,000, respectively.

The purchase or lease incentives are applied at point-of-sale (i.e. at dealerships) directly on the bill of sale or lease agreement of new eligible ZEVs that are purchased or leased on or after May 1, 2019. For leased vehicles, incentives will be prorated based on the length of the lease.

The federal purchase incentive for zero-emission vehicles is applied in addition to any provincial zero-emission vehicles incentive that might be available.

Within a calendar year, individuals can get one incentive and businesses can get up to 10 incentives.

A 100% write off in the first year is available to businesses that have purchased ZEVs for work and which are available for use on or after March 19, 2019 and before January 1, 2024. A phase out will begin for ZEVs that become available for use after 2023.

Note: As an employee, if you used your personal ZEV for work in 2019 and have a T2200 from your employer confirming that you are required to use your vehicle to earn employment income, you will be able to claim the enhanced CCA deduction. Refer to the CRA Employment expenses guide for more information.

You can claim the enhanced CCA deduction in one of the two new CCA classes for eligible vehicles that are a plug-in hybrid (with a battery capacity of at least 7 kWh) or are fully electric or fully powered by hydrogen.

- Class 54 for motor vehicles and passenger vehicles excluding taxicabs and automobiles used for lease and rent (for zero‑emission vehicles that would normally fall in Class 10 or 10.1)

For this class, the CCA rate is 30%, but a higher deduction (up to a maximum of 100%) might apply for certain eligible vehicles. The capital costs will be deductible up to a limit of $55,000 plus provincial sales tax for 2019.

- Class 55 for automobiles for lease or rent and taxicabs (for zero‑emission vehicles that would normally fall in Class 16).

The CCA rate is 40%, but a higher deduction (up to a maximum of 100%) may apply for certain eligible vehicles. The capital costs will be deductible up to a limit of $55,000 plus provincial sales tax for 2019.

If you’re self-employed and you purchased a ZEV for your business, you can claim the enhanced CCA deduction for your vehicle by following these steps in H&R Block’s 2019 tax software:

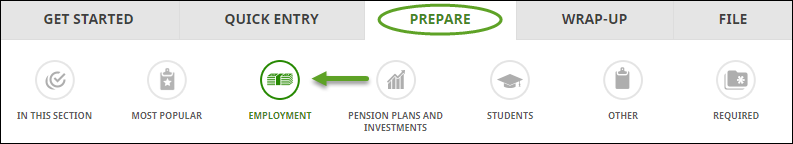

- On the PREPARE tab, click the IN THIS SECTION icon.

- In the Self-employment income and expenses box, click the Add This Topic button.

- Click the EMPLOYMENT icon. You’ll find yourself here:

- If you are filing a:

- T2125 form: Under the BUSINESS AND SELF-EMPLOYMENT INCOME section, select the checkbox labelled Statement of business or professional activities (T2125), and click Continue.

- T2125/TP-80 form: Under the BUSINESS AND SELF-EMPLOYMENT INCOME section, select the checkbox labelled Business or professional income and expenses (T2125/TP-80), and click Continue.

- On the T2125 (or T2125/TP-80) page, answer Yes to the following question: Do you need to make any capital cost allowance (CCA) claim for assets related to this business?

- In the CCA section, enter details related to the ZEV.

To claim enhanced CCA for the ZEV you used to earn employment income, follow these steps in H&R Block’s 2019 tax software:

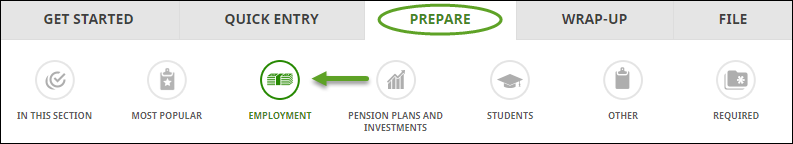

- Under the PREPARE tab, click the IN THIS SECTION icon.

- Under Employment Expenses box, click the Add This Topic button.

- Click the EMPLOYMENT icon. You'll find yourself here:

- Under the EXPENSES heading, select the checkbox labelled Employment expenses then click Continue.

- On the Employment Expenses page, answer Yes to the question: Do you have motor vehicle expenses to claim?

- Return to the top of the page. Select Vehicle expenses from the green Go To Page dropdown menu

- Answer Yes to the question: Do you want to claim capital cost allowance for this vehicle?

- Enter details related to the ZEV.

- Zero-emission vehicles (Transport Canada website)

- Zero-Emission Vehicles (CRA website)

- T4002 Self-employed Business, Professional, Commission, Farming, and Fishing Income (CRA website)