Tax credit for donations and gifts (Schedule 9 and Schedule V)

Important: As of January 1, 2018, the First-time donor’s super credit (FDSC) has been eliminated. The 2017 tax year was the final year to claim it.

You can claim a tax credit for the donations you or your spouse or common-law partner made during the year on the Schedule 9: Donations and Gifts form. If you’re filing a Québec tax return, you’ll also need to complete Schedule V: Tax Credits for Donations and Gifts.

Note: The Schedule 9 and Schedule V forms are combined in H&R Block's tax software.

You can claim a tax credit for your donations (money, cultural and ecological gifts, or capital property) if you:

- Donated to a qualified organization and

- Received an official donation receipt for the donated amount

You can claim 15% on the first $200 of your contributions and then 29% on the rest (up to 75% of your net income).

Note: If you made donations after 2015, and your taxable income for the year was over $200,000, you can claim 33% on amounts donated that are over the first $200. Refer to the Canada Revenue Agency (CRA) website for more information.

Tax tips:

- If you and your spouse have donations for the year, you can combine the donation amounts and claim them all on one partner’s return to get a higher tax credit. Generally, it is more beneficial for the higher income spouse to claim all donations.

- You can even save all your donation receipts (up to 5 years) and claim them in a future year, provided you haven’t already claimed them, to receive a higher tax credit.

If you’re eligible to claim the federal donations amount, you’re also entitled to claim a corresponding provincial tax credit, the value of which might vary in amount depending on which province or territory you live in:

Qualified organizations can be any of the following organizations that can issue official donation receipts and appear on the publicly available list that the Canada Revenue Agency (CRA) maintains. The only exceptions are the United Nations and its agencies and the Government of Canada or a province or territory.

- Registered charities

- Registered Canadian amateur athletic associations

- Registered national arts service organizations

- Registered low-cost housing corporations for the aged

- Registered foreign universities (as of February 27, 2018 registered universities outside of Canada no longer need to be prescribed in Schedule VIII of the Income tax regulations)

- Registered municipalities or public bodies in Canada or those performing a function of government in Canada

- Registered foreign charitable organizations

- Recognized political education organizations

- The Organisation internationale de la Francophonie or one of its subsidiary bodies

- Registered museums or cultural or communications organization

It’s important to remember that qualified organizations are not required by the CRA to issue receipts. In fact, many of these organizations have specific criteria for giving donation receipts. For example, some organizations require the donation amount to be at least $20 for a receipt to be issued. It’s best to check with the organization beforehand on what its criteria are for issuing a donation receipt.

Note: If you donated through your employer or a company program, you likely won’t receive a donation receipt. However, your donation amounts will be shown on the relevant information slip (such as a T4, T4A, T3, or T5013).

Did you know? If you have lightly used furniture or household goods that you no longer need, you can donate these to your local furniture bank or a charitable organization like The Salvation Army. Not only will you be helping someone in need and prevent the item from going into a landfill, depending on the type of item, you’ll also receive a tax receipt for the item’s fair market value.

You have up to five years to claim your donation amounts (or 10 years for a gift of an ecologically sensitive land made after February 10, 2014). Keep in mind, you’ll need to claim your carried forward donation amounts from a previous year before you claim the donation amounts for the current year.

Note: Remember to keep a record of your carryforward amounts in case the CRA asks to see it later.

Important: If you want to carry forward all or some of your donation amounts from this year, do not enter them into your tax return; instead save the receipt(s) and claim the amount on a future tax return.

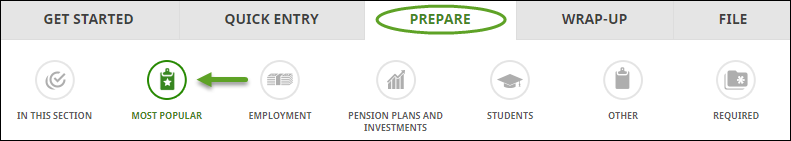

To complete your Schedule 9 (and Schedule V) in H&R Block’s 2019 tax software, follow these steps:

-

On the PREPAREtab, click the MOST POPULARicon.

You'll find yourself here:

-

Under the CREDITS section, select the checkbox labelled Donations and gifts

(or Tax credits for donations and gifts, if you’re filing

a Québec return), then click Continue.

- When you arrive at the page for Donations and gifts, enter your information into the tax software.

Check each section below for help completing certain fields on the Schedule 9/ScheduleV. Remember, Canadian residents who live outside of Québec will not see fields from the Schedule V form. Information that’s specific to Québec residents is marked with (QC).

Important: Take special care to make sure you’re entering your donation amounts in the correct section of this page. Entering your donation amount in the wrong field could change the amount of credit you’re entitled to.

Donations on a slip – If you donated through your employer or a company program, you might have donation amounts on your T4, T4A, T3, or T5013 slip. Don’t enter these amounts on the Schedule 9 and/or Schedule V in H&R Block’s tax software. Instead, report these amounts when entering the appropriate slip on the QUICK SLIP page of the QUICK ENTRY tab. The software will automatically claim the donations you entered on your information slips to maximize your return.

Note: To keep things simple, you can include all donations made to the same organization as one amount.

Generally, your donations to a charitable organization can include the following:

- Money such as donations by cash, cheque, credit card, money order, wire payment, or electronic funds transfer

- Merchandise*

- (QC) Food products such as eggs, dairy products, meat, fish, honey, fruits, vegetables, grains, and nuts, donated after March 26, 2015, that you produced as a registered agricultural operation

- (QC) A work of art donated to a Québec museum

- (QC) A permanent public work of art that’s installed in a public space or

- (QC) A building for cultural purposes, one that can house artist studios or one or more cultural organizations in Québec

*For the purposes of the charitable donation tax credit, merchandise refers to items of value that can’t be classified as a donation in gifts or property as described below.

Notes:

- Enter the above donations in the section titled Donations you made to organizations in 2019.

- If you donated a public work of art or donated a work of art to a Québec museum and you received a TPF-712.0.1-V: Certificate of Disposition of Cultural Property issued by the Conseil du patrimoine culturel du Québec, enter this donation in the Donations you made in gifts or property in 2019section.

If you made any of the following donations in gifts or property, then complete the Donations you made in gifts of property in 2019 section:

-

A cultural gift such

as paintings, sculptures, books, and decorative art material that’s

of national importance

Note: For donations made after March 18, 2019, the cultural property no longer needs to be of national importance to qualify for the enhanced tax incentives.

- An ecological gift such as a covenant or an easement or, in the case of land in Québec, a real servitude that has ecological value

- Capital property,

which when sold results in a capital gain or capital loss and includes:

- Cottages

- Securities such as stocks, bonds, and units of mutual fund trust

- Land, buildings, and equipment

- Depreciable property (capital property such as land, buildings, and equipment) that is used to earn income from a business or rental property. Depreciable property wears out over time as it’s used and the cost of the property is claimed over several years (known as capital cost allowance) or

- (QC) A musical instrument that you donated to a public or private educational institution in Québec or an institution providing instruction in music

Note: If donating any of the capital property described above resulted in a capital gain (or loss), you’ll also need to complete the T1170: Capital Gains on Gifts of Certain Capital Property form.

- If you received a capital gain from donating the property, what was the amount?

You have a capital gain when you sell (or are considered to have sold) capital property for more than the cost of the property plus any expenses you paid to buy it (adjusted cost base) and sell it (outlays and expenses). You can calculate your capital gain by using the following formula:

Sale price of the property – (adjusted cost base + outlays and expenses)

If the result is positive, then you have a capital gain.

- What's the amount of the capital gains deduction you're claiming for this property in 2019?

You might be eligible to claim a capital gains deduction on the donation of your capital property. To calculate your capital gains deduction, complete the T657: Calculation of capital gains deduction page in H&R Block’s tax software. You can find this page under the PENSION PLANS AND INVESTMENTS icon on the PREPARE tab.

- If you have recaptured depreciation to include for this property, enter your amount

A recapture is when the amount you sold the depreciable property for is more than the undepreciated capital cost (UCC). This recapture amount must be included on your return as income in the year you sold the property. Click this link to learn more about calculating the recapture amount.

Do you have unclaimed donation amounts from previous years?

Your unused donations are donation amounts that you haven’t claimed before on your tax return. You can find these amounts on your official donation receipts and your returns from the previous five years.

Note: If you’re a Québec resident, your unused federal donation amounts might be different from your unused Québec donation amounts, as you might have claimed different amounts on your federal return and on your Québec return to reduce your tax payable.

If, in any of the previous five years, you claimed only a portion of your donation amounts, you can determine the amount of your unused donations by using the following formula:

Total donations made in the last five years (minus) Donation amounts claimed = Unused donations

Tax tip: Remember to use your oldest unused donation first and keep a record of which donation you’ve claimed when.

Keep in mind, you can either claim the full amount of your unused donation amounts or a portion of it to lower your tax payable for the current year.

- If you're a farmer, did you donate agricultural products (vegetables, eggs, meat, etc.) to a community food program?

If you’re a farmer in Ontario, British Columbia, or Nova Scotia and donated agricultural products to a community food program (a registered charity that distributes food to the public without charge), you might be able to receive the Tax Credit for Farmers Who Donate Food. This is a 25% tax credit on the fair market value of the donations you made during the year.

Agricultural products that qualify for this tax credit include:

- Fruits, vegetables, mushrooms

- Meat, fish, eggs, or dairy products

- Grains, pulses, herbs

- Honey, maple syrup

- Nuts, or anything else that is grown, raised, or harvested on a farm

Note: Processed products, including pickles, preserves, and sausages are not eligible.

- (QC) Did you donate $5,000 or more in money to a museum, cultural organization, or arts-related charity this year or last year?

A donation of $5,000 or more in money (donation by cash, cheque, credit card, money order, wire transfer, or electronic funds transfer) to any of the following organizations is known as a large cultural donation.

- a registered art-related charity in Québec

- a registered cultural or communications organization

- a registered museum, the Musée national des beaux-arts du Québec, the Musée d'art contemporain de Montréal, the Musée de la civilisation or a museum located in Québec and established under the Museums Act

If you made such a donation, you can claim the additional tax credit for a large cultural donation. Keep in mind that this tax credit can only be claimed once.

- (QC) Do you have an unused amount for a large cultural donation that you included in your 2015, 2016, 2017, or 2018 Québec return?

Although you can claim your large cultural donation only once, if you didn’t claim the full amount on your tax returns for 2015, 2016, 2017, or 2018, you can claim the unused portion this year.

Tax tip: The unused portion of a large cultural donation can be used in any of the four years following the year of the donation.

- (QC) Did you donate $250,000 or more in money to a museum, cultural organization, or arts-related charity? (if

you included this donation above, you can't claim it again)

You can claim a tax credit for cultural patronage if you donated at least $250,000 in money (donation by cash, cheque, credit card, money order, wire transfer, or electronic funds transfer) to one of the following organizations:

- registered art-related charity in Québec

- a registered cultural or communications organization

- a registered museum, the Musée national des beaux-arts du Québec, the Musée d'art contemporain de Montréal, the Musée de la civilisation or a museum located in Québec and established under the Museums Act

Tax tip: You can carry forward the unused portion of the donation amount (amount not claimed before) for five years following the year of the donation.

- (QC) Do you have a promise of donation registered with the Minister of Culture and Communications? If so, enter the registration number located on your promise of donation

A promise of donation is one where you agree to donate at least $250,000 to the same organization over a period of up to 10 years (at least $25,000 per year). For you to be able to claim the tax credit for cultural patronage on your promise of donation, it must be registered with the Minister of Culture and Communications. You can find the registration number on the promise of donation receipt.

- (QC) How much did you donate? (if you made a promise of donation, you have to claim at least $25,000; otherwise, you need to claim at least $250,000)

You can find the amount you donated on the official donation receipt. Remember, to claim the tax credit for cultural patronage you must have donated at least $250,000 or, in the case of a registered promise of donation, at least $25,000.

- (QC) Do you have an unused amount for a cultural patronage donation that you included in your 2014, 2015, 2016, 2017, or 2018 Québec return?

If you didn’t claim the full amount of your cultural patronage donation from 2014, 2015, 2016, 2017, or 2018, you can claim the unused portion on your return this year. You can determine the unused portion of your donation amount by comparing the donation amount on your official receipt with the amount that you actually claimed on your tax return.