Yukon Small Business Investment Tax Credit

The Yukon Small Business Investment Tax Credit is a non-refundable tax credit which you can claim if you invested in small Yukon business corporations. According to the Yukon government, eligible small business corporations are private or co-operative corporations with:

- Less than $25 million in assets

- A permanent establishment in the territory, and

- At least 50% of assets and payroll in the Yukon

You can claim the Yukon small business investment tax credit if:

- You were a resident of Yukon on December 31. 2019

- You were at least 19 years of age at the end of the year, and

- You received a YSBITC-1 Certificate from the Yukon government which shows the credit amount you can claim

You can claim up to 25% of the value of eligible shares and subordinated debt that you purchased from eligible Yukon businesses during 2019 or in the first 60 days of 2020. The amount of the credit that you can claim will be shown on your YSBITC-1 Certificate.

The maximum amount that you can claim for the year is $25,000, including any unused amounts from previous years. Any unused credit amount can be carried back 3 years or carried forward up to 7 years. Refer to your notice of assessment (NOA) or reassessment to determine any unused credit amounts that you may have.

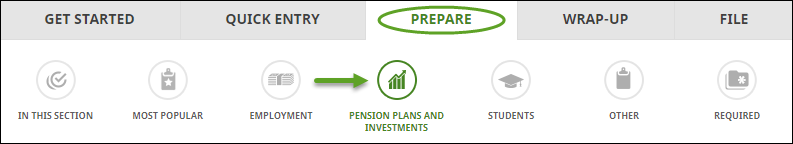

Follow these steps in H&R Block’s 2019 tax software:

Important: Before you begin, ensure that you told us you lived in Yukon on December 31, 2019.

- On the PREPARE tab, click the IN THIS SECTION icon.

- In the Investments box, click the Add This Topic button.

- Click the PENSION PLANS AND INVESTMENTS icon. You’ll find yourself here:

- Under the INVESTMENT INCOME heading, click the checkbox labelled Yukon small business investment tax credit.

- When you arrive at the Yukon small business investment tax credit page, enter your information into the tax software.