T4RSP: Statement of RRSP Income

You’ll receive a T4RSP: Statement of RRSP income slip to report the income you received or withdrew from your RRSP plan, as well as any income tax you’ve paid on it.

Note: If you’re a resident of Québec, you’ll receive a Relevé 2 (RL-2) slip instead.

A T4RSP slip also shows the amount you took out from an RRSP under the Home Buyers Plan and/or the Lifelong Learning Plan, as well as any amount transferred from an RRSP to a spouse or common-law partner due to a marriage or partnership breakdown.

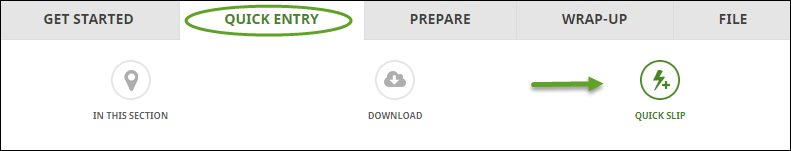

Follow these steps in H&R Block's 2019 tax software:

- Type T4RSP in the search field and either click the highlighted selection or press Enter to continue.

- When you arrive at the page for your T4RSP, enter your information into the tax software.