New Brunswick Labour-Sponsored Venture Capital Fund Tax Credit

Important: Effective 2017, you can no longer claim the labour-sponsored funds tax credit for federally registered funds.

If you purchased shares from a provincially registered labour-sponsored venture capital (LSVC) corporation based in New Brunswick in 2019, or within the first 60 days of 2020, you might be able to claim the New Brunswick labour-sponsored venture capital fund tax credit.

If you purchased shares on or prior to March 17, 2009: You are eligible for a 15% non-refundable tax credit, up to a maximum of $750 per year.

If you purchased shares after March 17, 2009: You are eligible for a 20% non-refundable tax credit, for a qualifying investment of $10,000 (up to a maximum of $2,000 per year).

Remember: You must hold your purchased shares for 8 years, otherwise you must repay the credit.

Note: You can’t use these shares to claim any other tax credit or deduction, except for an RRSP deduction.

If you decide to print and mail-in your return to the Canada Revenue Agency (CRA), you’ll need to include your NB-LSVC-1 certificate. If you’re filing electronically, keep this supporting document with your records in case the CRA asks to see it later.

Follow these steps in H&R Block's 2019 tax software:

Before you begin, make sure you told us you lived in New Brunswick on December 31, 2019.

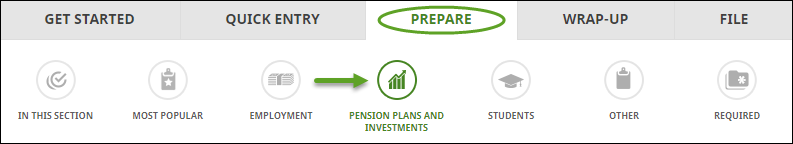

- On the PREPARE tab, click the IN THIS SECTION icon.

- In the Investments box, click the Add This Topic button.

- Click the PENSION PLANS AND INVESTMENTS icon. You’ll find yourself here:

- Under the INVESTMENT INCOME heading, select the checkbox labelled New Brunswick labour-sponsored venture capital fund tax credit, then click Continue.

- When you arrive at the page for your New Brunswick labour-sponsored venture capital fund tax credit, enter your information into the tax software.

Once you’ve completed this page, you’ll also need to enter the provincial tax credit amount shown on your NB-LSVC-1 slip on the All other deductions page of H&R Block’s tax software to claim the net cost of shares for your provincially registered fund. To do this:

- On the PREPARE tab, click the OTHER icon. You’ll find yourself here:

- Under the MISCELLANEOUS heading, select the checkbox labelled All other deductions, then click Continue.

- When you arrive at the All other deductions page, enter the provincial tax credit amount as shown on your paper NB-LSVC-1 slip in the field labelled Provincial labour-sponsored funds tax credit.