Certified film property

If you have film property (including television shows), you need to apply for and receive a Canadian film or video production certificate (part A) and/or a Certificate of completion (part B) from the Canadian Audio-Visual Certification Office of Canadian Heritage. Once your property has been certified, you’ll be able to write off the initial cost of investing in the film, as well as any carrying charges you’ve paid for its production and capital cost allowance (CCA).

Capital cost allowance (CCA) is the yearly deduction you can claim on depreciable property, as it becomes obsolete over time. Your certified film can be included in a new class of depreciable property in order to speed up your rebate. For example, a motion picture film (typically considered to be a property of class 10(q)) becomes property of class 12(n) after it’s been certified, making it a certified feature film, and can therefore be written off a little faster.

Note: If you have a loss (including your share of a partnership loss) from claiming CCA on your certified film property, you’ll need to calculate your federal tax payable under alternative minimum tax on the T691 form.

If you’re a member of a partnership, you might receive a T5013: Statement of partnership income for your film property. Be sure to enter the information from this slip on the T5013 page of H&R Block’s tax software.

For residents of Québec, the refundable Québec tax credit for film production services (QPSTC) is jointly administered by the Société de développement des entreprises culturelles (SODEC) and Revenu Québec.

This tax credit applies to your production costs, like the cost of qualified labour and properties. You can claim up to 25% of the expenses you’ve paid for services provided in Québec. The expenses you’ve paid for computer-aided animation and special effects, such as shooting scenes in front of a chroma-key, increase the tax credit to an additional rate of 20% of the qualified labour costs of your film production.

You’ll need your net income from the certified film property when completing your tax return. To calculate this amount, follow these steps:

- Add the income from your investment in the certified film property (before CCA or carrying charges, if applicable) that was acquired before March 1996 and any net taxable capital gains from the disposition of it.

- Subtract losses from this investment (before CCA or carrying charges, if applicable).

- Enter this amount in the designated field on the Certified film property (T691) page in H&R Block’s tax software. If the result is negative, enter "0".

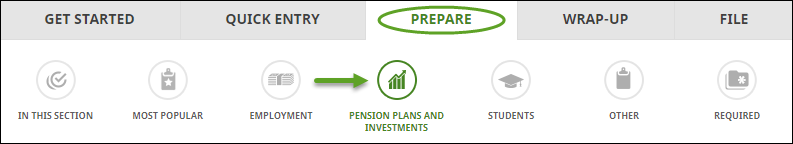

Follow these steps in H&R Block’s 2019 tax software:

- On the PREPARE tab, click the IN THIS SECTION icon.

- In the Investments box, click the Add This Topic button.

- Click the PENSION PLANS AND INVESTMENTS icon. You’ll find yourself here:

- Under the OTHER INVESTMENT INCOME heading, select the checkbox labelled Certified film property (T691), then click Continue.

- When you arrive at the Certified film property page, enter your information into the tax software.